Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

tupapa

-

Content Count

412 -

Joined

-

Last visited

Posts posted by tupapa

-

-

Well. Trading has shut down for a while, and we got within 7pts of my intermediate target. I thought we might reach the median of the trend channel today since it's only 60pts away, but it wasn't to be. Maybe tomorrow. Or we may try a rally first....

Chapeau,

I always found it somehow ironic how you assertively discouraged folks from trading intraday yet pretty much all discussion on Wyckoff trading was invariably focused on 1 minute trades.

Because that's what people wanted. Enabling it was my error.

I would like to participate more on the longer time-frame discussion.

As long as you can stay on topic, you're welcome to do so.

On that matter, does someone know of a way or resource that can be used to identify trading instruments that are in a range on the daily/weekly? Maybe a combination of indicators? To avoid having to scan visually through individual stocks?

-

Dow closes on Record High.....were are the bears?TW

Today was interesting. There was a another poke above the range that found no buyers and consequently price collapsed back into the range.

It now seems likely that the Dow will test the lower limit of the range, at 14,800.

This is my first target, where I take out 1/4 of my position and stay alert, since price could reverse.

If buyers don´t show up there, my next area of interest is 14,000, where I would scale out the second 1/4.

-

hi there,to me on the weekly chart there it seems to be a flat, and this one is poised to break higher

TW

Really? And what makes you think it's poised to break higher?

There was a clear rejection of resistance on wednesday and both yesterday and today buyers don't seem to have it in them to make a higher high.

To me, this suggests buyers are reluctant towards bidding above the top of the trading range, at least for the time being.

Lets wait and see.

-

Since you ask, here is my take on the Dow:

We are at the top of the Trading Range, so I´d say a short is legit if the red down wave materialises itself. Initial target is the lower limit of the Trading Range, although price needn't necessarily stop there.

If price breaks above the Trading Range, I´d take a long after a retracement.

-

This is my take on Silver:

Weekly:

The red SL is broken and we can see climactic VOL. followed by a lower volume test during the previous week.

Daily

The green Demand Line holds, resulting on a HL and for me, a reason to go long if price breaks above the most recent congestion above 22.

From here, I would wait for a test of R at 25, if price reverses I would close and go short, if it breaks above 25 price is back in the range and I would anticipate a test of the range MP at 30.

-

On the spec trades, as ‘planned’ atwas stopped out last Thu near 22.30

and, as planned, took on three loads at ~21.67 and one at ~20.67 last night – each load scaled arithmetically larger than previous…

Have two more scaled load limit orders at 19.67 and 18.67 to reach full allocation for this trade. May have to wait a while… or later, may have put stops above (oco’ing the limits) to fill the allocation instead ... I remain overall bullish on PM’s … but this ‘correction’ may last for some time… it has already become a long drawn out affair... largely a rotation out of etf's, etc. into physicals

…

all the best.

zdo

Hello Zdo, is your long silver a long term bet? What is your plan regarding trade management and do you mind sharing your rationale?

Also is there a particular reason why you buy silver instead of gold?

After yesterday's rally, I see very good support in both gold and Silver and I am bullish.

-

Anybody heard of Death By A Thousand Cuts?No but it sounds painful. What does it have to do with options?

-

Hi everyone,Nice to see such an active forum.

I'm an Options trader (expert level), and looking forward to interacting with fellow traders.

If any of you have questions on Options, please feel free to get in touch with me.

Best

Hari Swaminathan - OptionTiger

Just what I need, question:

If I think the S&P is going to fall, why would I want to use options instead of just shorting a Future?

I'd appreciate if you could explain the benefits of options, bearing in mind I know nothing about them.

Cheers

-

There are a couple of approaches that might work for an employed personFirst, assuming you are an "investor" and not an active trader, you can learn how to read the longer time frame charts and use options positions....this take a bit time...first to learn how the options work, how to manage risk and time frames etc....it can be done...you need to find the correct resources however and that can take some time.

.....

Hello Steve, I am interested in this. Do you know of any decent resources to get started??

Cheers.

-

I know, it was actually a joke, I am not advocating the use of indicators..

I did however, start using the AD line after reading the nature of risk, which you recommended. Mamis talks about the AD line and the New High, New Low being the language of the market.

I find these statistics legit, since they represent unadulterated market information, unlike technical indicators that rely on mathematics.

Anyway, you posted the New Highs/New Lows statistics and the Advance-Decline Volume a few days ago so I assume you rely on these rather than the AD line I posted.

Cheers

I don't necessarily agree with everything included in the books I recommend. And there's much else of great value in Mamis' three books.

But even if one uses the AD line, which is not "unadulterated", it isn't of much use if one doesn't know how it's calculated or what one should compare it to. The TICK(Q) and the AD line have little in common, nor should they be compared to the major indexes without regard to composition.

As for NH:NL and UV/DV, that's raw, unmodified data, and the NDX and the COMP are usually highly correlated. though not so much over the past four months.

-

Tupapa, what have you been doing, great seeing you around.Long time no see a sacrilegious MA in the W forum. :haha:

Not bad, enjoyin the markets from the distance

how are u??

how are u??I know that chart is dbs worst nightmare, missing the macd haha

I wouldn't call it my worst nightmare. If people want to use indicators, there's not much I can do about it. However, those who do will take far longer to understand all this, if they ever do, than those who set them aside.

-

The AD Line is relatively useless for anyone but a fund manager, and not much even then, because of how it's constructed.Isnt it the same as the tickq for day traders?? Can you elaborate? I thought id been using it succesfuly so far lol

-

-

For those who are following daily charts, the following may be helpful. The short and long are extrapolations of last week's charts.Given what's been posted elsewhere recently about trading price action being "nonsense", these charts have more than one purpose, including the four years' worth posted in the Foresight thread.

Note that it is necessary to place the entry more than a point away from the trough or the peak of the RET unless one can afford a fairly wide stop.

Did you trade todays NQ auction? I found the first 45 minutes a complete nightmare to follow..

-

-

-

Out of the trading range, yes. And if one had been paying attention to what price was doing on the 8th and 9th, he would have been short on the 10th, not looking for a 20pt upside on the 12th.Since you asked.

Now, of course, we're holding in a previous trading range that formed some time ago, but that is of course of no interest here, so whatever happens will likely be a surprise to those who aren't prepared.

Hey DB, why did you go short on the 10th if price is holding support?

-

Yoday=

-

-

1. Does it matter?2. Hits R and reverses.

1- I would say so, given the emphasis throughout the forum on trading only at Support and Resistance.

2- This seems so subjective, I cant see why sometimes you enter on the first drop at Resistance but others you wait for a LH. Then again, I haven't been looking at this for years...

-

-

1. Break of the DL (not drawn) and FTB.2. Rejection of R

3. Congestion

1- So you take this setup regardless of where it takes place, not necessarily at S/R?

2- How do you define Rejection?

-

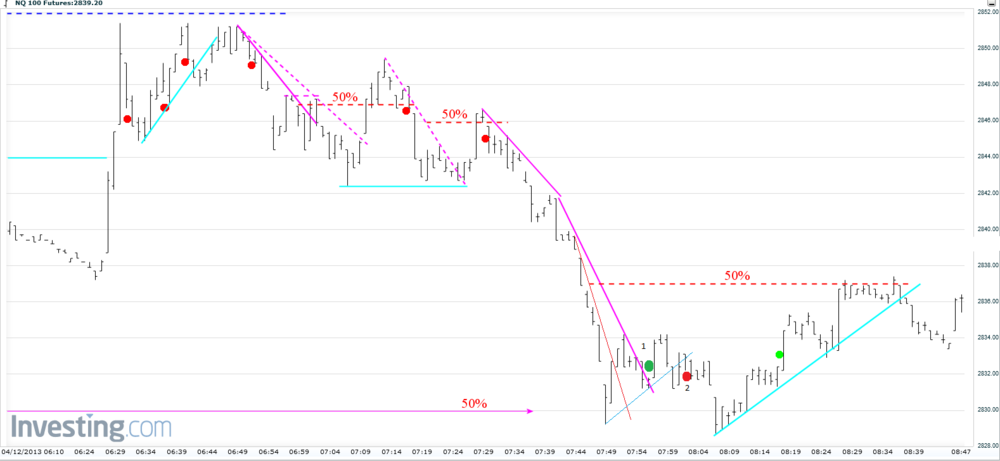

As I said above, I would not have expected this morning to be quite so boring. But trading began to come alive with the exit from the hinge (below).For the daily context, see yesterday's chart post. For the premkt, see chart 1.

Chart 2 shows the opening gambits without the hinge so that the entries and exits can be more clearly seen. Since there were no RETs to speak of, I elected to enter off S/R reversals, as long as there was S/R to use. The hinge then formed, which is an overlay on Chart 3, which is otherwise identical to Chart 2.

The last, of course, is the entire session, at least until I quit due to the volume dryup and the sideways trendlessness.

Gee, it would be so much easier if S&R "worked".

Three questions from yesterdays trading:

-

I was more laughing at the quote "But gold is a natural thing"

How often people think that because something is natural it is 'good' or has some sort of positive value....does it then mean anything not natural cannot be valued....

(Take this in the light hearted approach it is intended - or dont)

Actually gold is natural since it is caused by nature, unlike the paper some exchange, which is printed by a bearded Jew and created out of thin air.

And personally, when it comes to valuing an asset, I'll take the one that has been used as a store of value sine the origin of mankind, above the one which is controlled and manipulated by a few corrupt in power.

As for the gold chart:

We are still at support so I am only looking for longs unless there is a breakout.

Price had a sharp decline to 1540 and rebounded with Strength. If price now makes a Hl above 1540, this is a good buy or an opportunity to add longs.

Stops are placed below the danger point, that is 1540.

Trading the SLA/AMT Intraday

in The Wyckoff Forum

Posted

So since 22 didn´t hold, your next "target" is the median of the channel?