Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

-

Not to detract from the forex stuff but I thought the movement on crude oil (CL) today might turn out something interesting. If I weren't watching oil I would want to know that this pattern was occuring just to watch.I forgot mention that oil inventory comes out at 8:30 arizona time which produces crazy volatility which you saw if you started watching it.

-

-

Size your targets to the size of the swings prior to entryThe correlation between swing size and trade planning was a big breakthrough moment for me a while ago. I could see swing sizes but I didn't necessarily translate that to the trade management. Still working on it.

-

You know what is interesting dinero? You are showing some nice results w/o touching the ES. At one time around here that was the standard. If you didn't trade the ES, you weren't a trader.Mostly thanks to your posts about other futures. Hopefully everyone else will keep trading the ES as usual. I still haven't really spent much time with bonds during economic announcements. Its on my to do list. Oil and the soybeans keep me pretty busy. I don't have any time for trading this morning. I should be back at it tomorrow. I am always scared I'll miss that huge move on some day that I can't trade, even though I am still on SIM (I take my SIM trades very seriously).

-

-

-

There aren't too many out there that trades stocks on TL from what I have seen so I am not yet worried about anyone posting too many charts.

I can't really see your chart at all because it is too small.

-

Thank you all for your responses. Great points from all. I do see that the ultimate indicator is price and I plan on spending all my chart time developing an eye for reading PA.

There is this great trend in the threads I love that during the week posts are all about trades and the weekend addresses some philosophical issues. I can't tell you how much I enjoy this.

Thanks again.

-

Yes, I have known many who have tried to make it in this game. Those who have found some degree of success almost invariably have spent 10's of thousands of dollars over the years on "chart ornaments," only to find that the succes that eluded them finally came once they learned to trade with nothing other than price bars.Also shocking is how easy it is for someone who does come close to what you have called "the truth of the markets," to revert back to hanging chart ornaments on their screens.

Thales

I am relatively new to trading and took the advice of many here on TL and I haven't ever used indicators at all on futures, like none at all. I sometimes wonder if I am missing some part of the learning process since so many have used them early on in trading.

I was showing my friend a trade I made on the ZS the other day and he likes the idea of bollinger bands so he wanted me to put it on my chart. I did and noticed that it would have kept me in the trade for the entire move if I had used it to confirm when to exit the entry.

Very likely a coincidence but it got me thinking, maybe I am not taking advantage of some useful indicator that would help me navigate when price gets moving lightning speed as it does on the ZS.

I also feel a little stupid when others talk about common indicators and I have no educated understanding of them. Do you think there are a select few indicators that everyone should at least become familiar with even if they aren't going to use them?

Do you think an indicator can train you to indentify something when you are new? You can always lose the indicator once you develop the eye for it in simple price action.

-

It is with fear and trembling that I recommend Frost's & Prechter's Elliot Wave Principle. Elliot Wave theory can be very dangerous in the hands of human creatures, as we are creatures who seek control and certainty.

I hesitate even to press the "submit reply" button.

Thales

You certainly know how to get everyone interested. You're like the club leader of a 10 year old group of boys that got his hands on a porno to share with the group.:rofl:

I haven't heard many well known trading ideas mentioned in the market wizard books but Elliot Waves have been mentioned several times so I already have it on my list of things to get some familiarity with. I will take your words of caution seriously.

Thanks for the reading and to your currency friend. Too bad we can't get him posting with the group.

-

I always enjoy looking at other people's chart analysis especially for stocks to see another perspective but also to get ideas on where a potential move is brewing. Stocks create such a vast list of potential trades that it is impossible to be watching most of what is happening. Many great traders mention that they simply wait for money to be lying around somewhere and just scoop it up with little effort. Brownsfan, would call that a "gimme" trade. My guess is that those types of setups happen quite often in the world of stocks but it can be very hard to be aware of them.

I thought a nice little thread of just annotated stock charts of setups you are watching or have come onto your radar would be not only interesting but also would spur some possible trades for those not watching what you are watching.

So here we go. I have made some great money on PMI in the past so I always am watching them as a way to play moves in housing. They are forming a nice little wedge around a reasonable S/R level I had marked even before the wedge began. I do think this could go either way but I will be watching this.

-

I caught today's first move again. That is fun managing a trade like that where you know you are in the money the whole time. I trailed my stop too tight which cost me a good portion but I got a little nervous when we pasted the top of the last upswing thinking we might be due for a reversal. Hope you caught that one too Brownsfan.

GCL was fun this morning. A lot of range bound trading.

-

Quick Question: Has anyone tried to mix any fundamental analysis with their trading style and to what degree?If you watch bloomberg TV - one day they are bullish for some fundamental reason, the next day they are bearish for the same reasons.

-

- So the answer from me is NO - just watch the price action.

I sometimes look at a price chart and make a trading plan without knowing what the instrument is. When you find out what it is its interesting then how often the brain wants to then interpret some rational reasoning for why it then will go up or down.

Its handy to know a broad based macro view sometimes, and to know when announcements are being made, just to keep out of trouble - but otherwise its all price action.

(i am probably longer term than many other traders here)

I would never use bloomberg TV or commentary like that for fundamental considerations but I appreciate your points. Many of the Market wizards mix fundamental ideas with their technical analysis so I figure there is a good way to mix them however, I am sure it isn't easy.

-

-

Well, look at you! I'm not a "candle" kind of guy (not that there is anything wrong with being a "candle" trader), but everything else sounded like poetry. You've come a long way over the last six months or so.Thales

I appreciate the encouraging words Thales. You've certainly done a great deal of mentoring for which I am grateful.

I wouldn't call myself a candle trader but the principle behind candles I find to be very useful especially on certain futures. I was frustrated with candles for a while because you can get different candles depending on your chart setting (ticks, minutes, etc.). Then I realized (after considering many of brownsfan's posts) that I don't really need one or 2 candles to make some certain pattern from a book. All I need is to be able to spot when price is tested in one direction and is quickly meet with lots of buying/selling. Once I realized this, I no longer had to worry about what chart I was using. I can spot that type of price movement over the course of 10 candles or 1 candle, doesn't matter. That was an epiphany for me.

Overall though, I wouldn't call myself any type of trader yet. After reading a lot of the market wizard series, I realized that I really need to try on many different trading styles in order to find what best fits my personal skill set and emotional capabilities. There are many ways to trade successfully but there is one ideal way for any given person to trade. If a person tries to trade in a way that is incompatible with themself, it is going to be a long hard road. I am currently in the dressing room trying many trading styles out trying to see what works and what makes my butt look big if you catch my drift.

Quick Question: Has anyone tried to mix any fundamental analysis with their trading style and to what degree?

For example, there are times I trade oil and find out there was some "fundamental" knowledge that might have helped me in determining if I should be looking for a breakout or reversal at S/R. It might just complicate things if you simply fill your head with large amounts of "fundamental" information but maybe if you could hone in on some specific set of facts going on in a market (i.e. just keeping up with oil inventory numbers), maybe that could help you.:shrug:

-

11-12-09: +$547.50Better day. What a fun spike that ZS was! Hope dinero was able to catch that with me.

That is funny you say that. I was really busy at work today so I knew I wouldn't be able to focus enough to trade what I wanted but I had a free moment at 10 minutes after the ZS opened to take a peak at the action. I went long just before that move and caught all of it. I felt pretty good and took a bunch more trades and threw away all the gains but that is what I do on my "no time for trading" days. I just practice watching price action and try to read each move where ever price may be. I don't post P/L on those days because I am not really trading to make any money. Glad to hear you got that move. I would like to think I might have caught it on a normal trading day and then quit trading the ZS. When I miss a good move now on the ZS I think, "SOB, I bet browns caught that one".

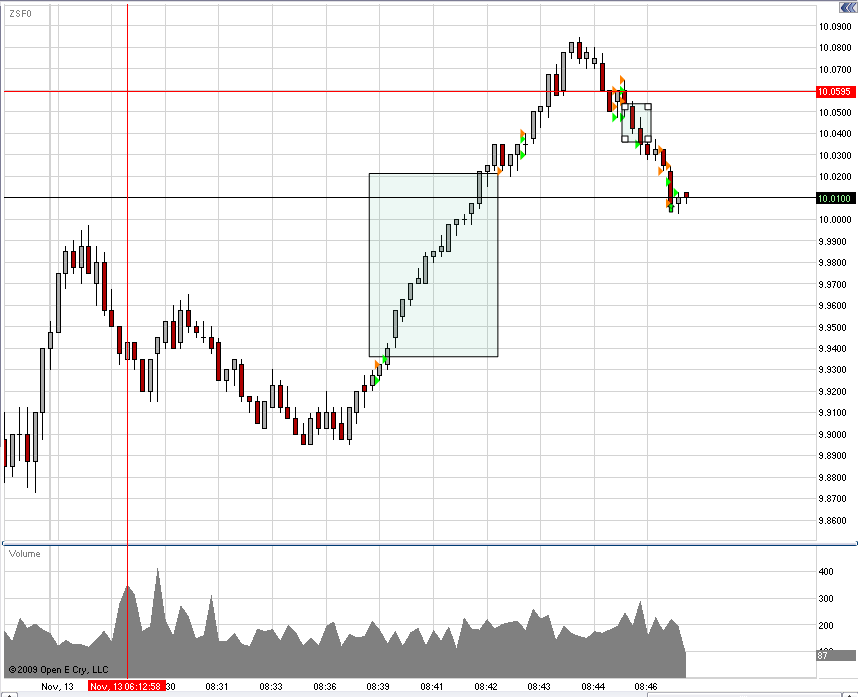

Here is why I caught the move from my quick analysis once I got on the ZS.

The downside price search finished somewhat quickly (square), there was a good candle formation I circled (down price rejection) and then candle printing really started speeding up just before and during the move (I used ticks). If I remember correctly, it was the speed up that caused me to get long just above the short term resistance at the blue line.

-

This was a huge move and very fast move for the Aussie dollar. Watching for a fast downward move.

UPDATE: We have breakthrough but things are going slowly. Stop is 1 tick above the breakout level. Support was found exactly at the top of an upswing a few days back that I drew as a possible support point.

-

Watching the 6B right now for a breakdown.Got 5 ticks out of the last move and now watching for the next one

Watching this one

Update: Everything just keeps going higher right now instead or breaking down. We watch and wait

The 6J broke up and I almost got a good piece of it but I accidentally clicked the limit instead of the market order and it just flew past me. The 6E and the 6B might make there move soon but I need to sleep....

The 6B brokedown but there was too much support in that area.

-

-

If you could post charts of your trades with the notations that would be really helpful. Looking forward to seeing your progress.

Good luck.

-

Here is a related question.

What do you think is the ideal set up for how you trade Brownsfan?

How many computers?

How many monitors? One for each future contract?

Ordering on each computer or limit ordering one main computer?

-

TT I wondered whether you where familiar with Joe Ross' Law of Charts? It is essentially 'price action' with all the usual 'patterns' HH HL HH...HH HL LH etc. Certainly don't want to lead anyone off track so I'll say no more at the moment.Thales posted Ross's "Law of Charts" pdf at the link below in case someone wants to go read through it.

-

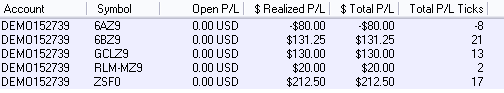

Had some good trades before I went to bed on the 6B after it had a huge move which I should have caught. Caught a nice move on the GCL this morning and one on the ZS. One of my better days. Not sure if it was just luck or improvement.

http://www.traderslaboratory.com/forums/attachment.php?attachmentid=15062&stc=1&d=1257867781

Trading Oil and Gold

in The Candlestick Corner

Posted

Oil 11/18/09. Just a quick look at where we stand on the long term chart. We touched the current trend line today about .5 seconds after oil inventory came out. I'll be looking for some major down swings over the next few days unless that trend line is broken to the upside.