Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

IMO the daily volume is only a part of the equation as that volume includes overnight trading. It also is a function of WHEN you are trading - if you trade during high volume times, then you can trade size accordingly. If you trade when it's slow and dead, you can't push too much.During the high volume times, I think you could do the following:

Oil: 100

Soybeans: 50

Russel: 100-200

ES: 250-1000

6E: 100

And those are ballparks - so while I think you could trade a 100 in the CL, during high volume moves you could probably push that more.

Also this is a function of HOW you enter. If you are all-in at one price and one price only, then you might have to come down a bit on those numbers. But if you can stagger in, then I think you could do that. For example, if the goal is to get long 100 CL, you could buy 25 ct's @ 4 levels or send a mkt order for 25, wait, send a 15 lot order, then a 30, etc.

The good news is that you can literally make a good living trading 1-2 ct's if you wanted. I know it's nice to think about 50 or 100 lot orders but it is nice to know that you do not have to do that.

The big problem I see with entering at higher volume times with a larger order is you don't know if that volume will dry up and you will be left trying to exit a position with very few trades happening.

Taking this further; once I get my 100 lot order in on the CL, my understanding is that I also have to figure out how to conceal my stop loss from other seeing it or a large trader might close in to stop me out. Does that mean I can't have my stop loss sitting on my DOM for execution?

-

-

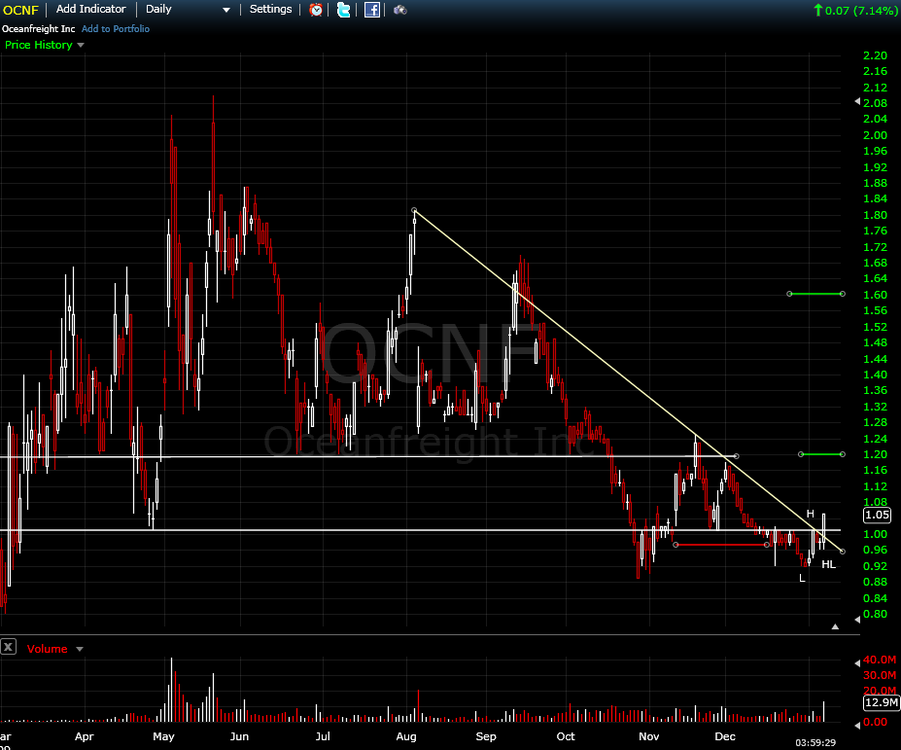

I know Thales isn't a fan of the cheapies but I liked this one enough buy the breakout. I bought in at 2.20. Maybe this is a good look at the range expansion/contraction. You can see the range contracting in cycles and I bought the breakout of the last range/wedge.

We'll see if it can maintain momentum. Stop is at 1.96.

-

One thing about oil and gas, as far as price is concrned, they are very well -behaved instruments.Best Wishes,

Thales

That is why they are the primary instruments I SIM trade right now as you can see on my p/l posts on the p/l thread. I am surprised you don't trade them more.

-

This is a great example of what I mean when I say that the market cycles between periods or range expansion and range contraction (and I am not taking credit for the observation).Thales

This chart was extremely interesting to me.

How far can you use range expansion and contraction in your trading?

Do you use it mostly to set profit target expectations?

If you were going to teach someone new to trading, what would your "range expansion/contraction" talking points be?

This idea and the chart seem like a huge key to some of your subconscious trading decisions that I am surprised there isn't more discussion of it.

-

-

I honestly do not pay any attention to that sort of information. I let others slug it out, and I use the chart to align myself with the strongest slugger. If they are going to fight to a draw for some time, the chart will tell us that too, don't you agree?Best Wishes,

Thales

I totally agree but to be aware the "fundamental" news can help in understanding irregular price movement perhaps. For example, I don't want to interpret how the oil inventory report on Wednesday morning will affect oil futures prices but I want to know when it comes out so I can be ready for some irregular price movement. Does that make sense?

You should get your daughter scanning through some stock charts and have her throw some up on this thread. Might be a fun change of pace from the currencies. Just a thought. Maybe she can find some BBBO to trade.

-

GOOGStill watching GOOG - still too soon for me to short, and I really am interested in whether its sets up a long opportunity. It pierced the upper level of the zone I bracketed last night. Ideally price drops to the 580 level and then we see what happens.

From a fundamental standpoint, I'd also think Google will have some odd movements right now since people are trying to digest the future impact all the news that is coming out at the Consumer Electronics Show right now in Las Vegas.

-

Now that phrase is an eyebrow raiserBest Wishes,

Thales

:rofl:

I wasn't sure what to call the end of the wedge as sellers and buyers come together and price volatility narrows to almost zero. Once I wrote it, I liked it so I went with it. I actually forgot about it until you posted this and it made me laugh again.

-

I'm just leaving it at 1-2 contracts being traded for purposes here. I thought about doing some adjustments but I just don't have the time right now to do it the right way.Whatever you see me post, you can just multiple good or bad on how many contracts you might be trading if you were mimicking my results. For example, a 10 lot account would have made $5k today.

If you wouldn't mind sharing your experience with the various futures you trade, what is the largest lot amount you think you could trade on the following futures without having to conceal your trading size from others or without moving the price. In other words, how large can my lot size be on these futures and still trade them like I trade a 1 lot size?

Oil

Soybeans

Russel

ES

6E

I was considering this today and thought I was a bit out of my league in trying to make a good educated guess. Is there some sort of rule of thumb you can use related to daily volume?

-

Well, so long as you got it, I don't feel so bad. Have fun with it!Thales

Yea, because tomorrow he'll probably be taking it back with interest.

:rofl:

-

-

-

-

Hi all,I am looking for a discount stock broker (to trade stocks, not CFDs or spreadbetting) with the following criteria:

1) The account can be opened by a UK resident.

2) The account can be funded in British pound (GBP) and only the profit/losses would be exposed to the risk of currency.

3) No inactivity or monthly fees charged (eg. Interactive Brokers charge inactivity/monthly fees and would not suit me).

4) The account can be opened with an amount as low as GBP 6,000.

5) I will do less than 6 trades per year and I am looking to pay

commission fee per side of USD 8 maximum or GBP 5 maximum (eg. Selftrade, E-Trade, Barclays stockbroker are too expensive)

I made some research and I found the following stock brokers: Zecco, Just2trade, but I don't know if they allow UK residents to open an account and if the account can be founded in GBP. Does anyone know if they suit such criteria?

Any suggestions of brokers following ALL of the above criteria are welcomed.

Many thanks

If you are looking to make some real money, $10 USD commissions aren't going to kill you on 6 trades a year.

I have most of my personal financial business with Wells Fargo here in the USA and they give me 100 free trades per year on my trading account, my IRA trading account and my ROTH IRA trading account. That is 300 commission free trades per year and I get that every year. The price I pay is I have my mortgage, credit card, retirement accounts, checking, and savings account all with them. I do this because I like to simplify life. One bank statement and online portal that gets me to most of my finances.

See if the big banks where you live have similar offers for customers who do lots of business with them.

That's my

-

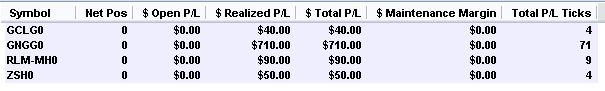

1/7/10: +$882

This is just SIM but it was an exciting day. I got out of several positions way to early (ES and GNG(natural gas)) and still did well. Over the past few days I feel like I am finally getting my method down and learning what I want to trade. It is funny how excited you can get over SIM results. I am definitely going to start taking some real money trades once my work load is not so heavy.

SIM

-

Hi Folks,Don't let the fact that this is Robert Prechter keep you from reading this short little interview. It is about trading, and succeeding at it, not Elliot Wave.

Best Wishes,

Thales

That was a great article for me since I am currently working hard at formulating my trading rules.

Thanks for sharing.

-

2) Elliot wave is a viable theory, so long as you use it for distinguishing tradable moves from corrective moves

If someone has a chance, could someone explain the distinguishment? I read through the elliot wave paper posted and some posts here and I am just not understanding something about this. Maybe I am overthinking it. :crap:

Thanks.

-

-

ARBReasonable setup for a breakout above resistence.

Broke out of R and trendline today and came back quickly on super low volume. I don't use volume very much but when volume comes in once resistence is broken and then price falls back down on much lower volume that seems to me a good sign that you will see some more upward movement. See charts below. I bought some a few minutes ago.

-

-

No problem, littlefish, I'm perhaps a bit too sensitive right now. I've had a couple of PM's in the last month or so from folks basically telling me I'm a fraud and wanting to know "what my deal is."My word, how stupid some people are. Please just delete those emails Thales and remember you have many grateful friends on TL that appreciate your thoughts and ideas immensely. I guess the eternal problem with the internet is that it lets everyone in, even the idiots.

-

-

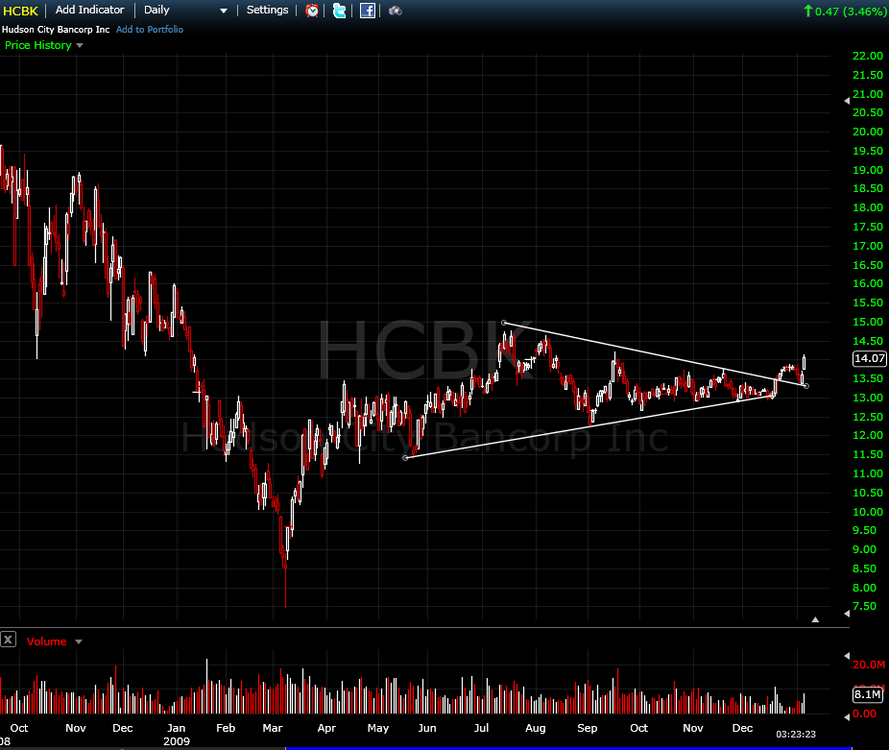

Interesting Charts for Technical Trades

in Stocks

Posted

The break below the Support level and nearness of the next level of resistance kept me out of it. Hope you are making some money from it.